|

Financial industry smarts for environmental professionals No 2 in a meandering series I had a chance to work on some reviews this past week for both ground leases and sale-leasebacks, so I thought it would be fun to talk about how these affect the way that environmental due diligence is performed and decisions are made about environmental risks.

Before I get into ground leases and sale-leasebacks, let’s make sure everyone is clear about the definition of the collateral that is securing a loan or lease or other credit being extended. In addition to real property - land and buildings - the collateral can include a ground lease, equipment, and the value of contracts. (By the way, when you hear the term “boot collateral,” that usually refers to real estate or other property that is included in the loan but does not contribute value to the security package.) Ground Lease A ground lease means that the ownership of the underlying land is different from the buildings or factory placed on the land. Most ground leases have very long terms such as 50 or 99 years. In the U.S., at the end of the lease term the improvements on the land typically revert back to the lessor. However, in some countries such as Japan the lease term tends to be a little shorter and all improvements must be removed at the end of the lease term. Whenever possible, I try to review the ground lease before I do any due diligence on a loan with this feature. That way, I can review any disclosures made by the ground lessor, any indemnities being made or required, and any terms and conditions required at the end of lease term or in the event of transfer. Our legal team ensures that the terms of the lease agreement are acceptable to the bank in the event that there’s a default on the loan and the bank considers taking title to the asset. Understanding the ground lease can help determine the scope of the environmental assessment, for example:

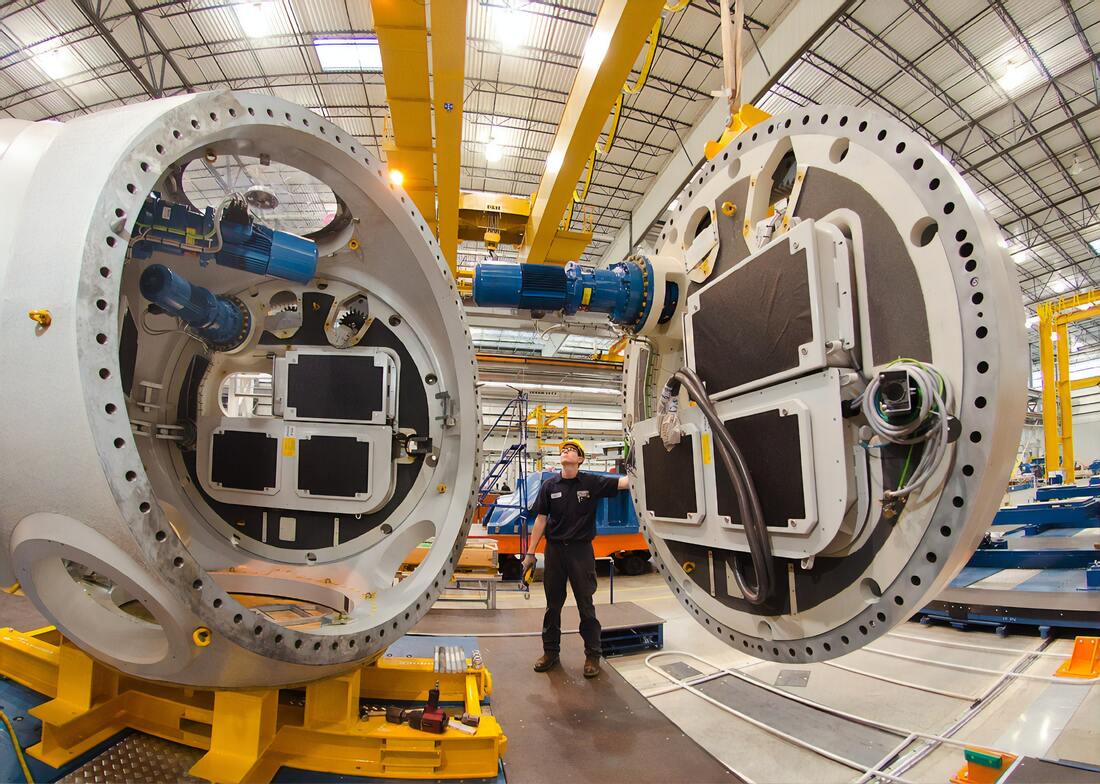

Sale-Leaseback A sale-leaseback transaction involves a simultaneous sale of the property with a lease of the property back to the seller. The property could be real estate, but it could also be equipment or other assets with sufficient value to serve as security, everything from airplanes to forklifts to conveyer belts. I’ve even worked on transactions involving the sale-leaseback of every piece of equipment in a factory. Why would a company want to enter into a sale-leaseback type of financing, given the complexities and tax issues involved?

From an environmental standpoint, there is one key consideration for sale-leaseback transactions. Rather than being a lender, the bank becomes the owner of the property or equipment, so any due diligence needs to be scoped to identify risks that would affect a property owner. In the United States, the bank no longer benefits from the secured creditor provisions in the federal Superfund law or state cleanup laws. In addition, the bank could become jointly liable for environmental compliance under the federal hazardous waste law, the Resource Conservation and Recovery Act, and state counterparts.

Any due diligence for a sale-leaseback needs to consider not just contamination at the property, but also other conditions or operations at the property that could result in an owner obligation or liability. Once the due diligence gets reviewed by the technical experts, a consultation may be needed with legal counsel to ensure that both the purchase agreement and the lease agreement reflect the true conditions at the property and include provisions that protect the bank from environmental liability. There are some kinds of businesses that are simply not good candidates for this kind of transaction, including those with intensive chemical use like plating shops and hazardous waste management companies. Photo credit: Science in HD on Unsplash Views and opinions expressed on my blog are mine alone and have not been reviewed or approved by my employer. Any errors in my blog posts are entirely my own.

1 Comment

|

Marty WaltersEnvironmental Scientist Archives

March 2021

Categories

All

|

Proudly powered by Weebly

RSS Feed

RSS Feed